GOVERNOR CHRISTIE’S EDUCATION LEGACY: STARVE SCHOOLS, ABANDON STUDENTS

Governor Chris Christie’s eighth – and last – State Budget seals his public education legacy. New Jersey public schools, over the duration of Governor Christie’s tenure, have endured a near total deprivation of the aid required under the School Funding Reform Act (SFRA), New Jersey’s weighted student funding formula.

The result: New Jersey’s 1.3 million students have been abandoned, left to suffer annual cuts in classroom teachers, support staff and other resources essential for school success.

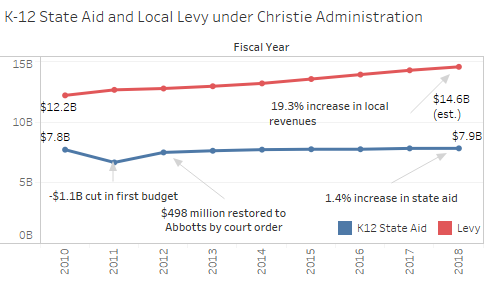

For FY18, the Governor has proposed no school aid increase over last year. When the Governor took office in 2010, state aid totaled $7.9 billion. If his proposed FY18 budget holds, state aid will be $8 billion when he leaves office, amounting to a scant 1.3% increase over eight years. That’s nowhere near enough to cover inflationary cost increases, changing student demographics, or the implementation of state and federal mandates and new academic programs developed over almost a decade.

While the Governor has shortchanged schools, local property taxes to support school district budgets will have increased by approximately $2.4 billion, or 19%, from 2010 to 2018 (assuming a 2% increase between FY17 and FY18). The annual average property tax increase is 2.3%, just over the mandated 2% cap signed into law by the Governor in 2010.

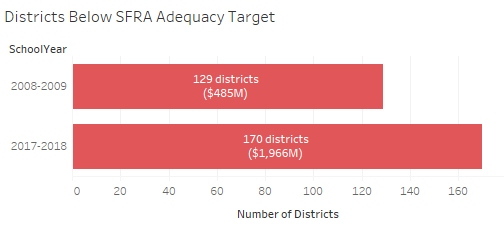

Governor Christie will also leave behind a huge hole in local school budgets for the next administration to fill. The number of districts spending below the level necessary to provide students with a “thorough and efficient” education as determined by the SFRA formula has risen from 106 to 170, a 60% increase. More alarming, the shortfall in districts that are below their “adequacy budgets” now totals $1.9 billion, with state aid comprising about 60% of the deficit.

“Make no mistake, Governor Christie is directly responsible for the painful cuts schools must make again this year – whether in Kingsway Regional, Freehold Borough, Clifton, Bayonne, Newton or a host of other districts across the state,” said David Sciarra, Education Law Center Executive Director. “The Christie Administration has now solidified its record as the most hostile to public school children in modern New Jersey history.”

The SFRA Formula

As the New Jersey Supreme Court has made clear, the “adequacy budget” is at the heart of the SFRA formula. Each district’s adequacy budget, calculated annually, is based on weighted student enrollment, thereby ensuring that funding is available for programs to address the needs of at-risk (low-income) students, English language learners, and students with disabilities.

A district’s adequacy budget is funded through state aid and local property taxes. The fiscal capacity of a municipality, based on property wealth and average income, determines the local revenue obligation, called the “local fair share.” The remainder of the adequacy budget is funded through state aid.

The goal of the SFRA was to bring all district budgets to adequacy within a reasonable timeframe. Additional state aid owed to districts under the new formula, first implemented in 2008-09, was to be phased-in over a number of years, with a quicker phase-in for districts spending below adequacy. Districts that were below their local fair share would be responsible for raising the tax levy to reach adequacy, though there were no state mandates placed on districts or municipalities to do so.

Governor Christie’s refusal to fund the SFRA formula has moved districts farther from the goal of adequacy. Here is how the three essential components of the SFRA have fared during the Governor’s tenure:

District Adequacy Budgets

In 2008-09, the first year of SFRA implementation, approximately 20% of districts were spending below their adequacy budgets. In the 2017-18 school year, the number of below-adequacy districts will grow to 30%. Even more striking, the statewide funding gap in the below-adequacy districts quadrupled from $415 million in 2008-09, to over $1.9 billion in 2017-18. During the same time frame, adequacy budgets grew 23% due to changes in student demographics and inflation. Because state and local revenues did not keep pace, many districts have dropped below their adequacy targets.

State School Aid

In his first budget, Governor Christie cut over $1 billion in state aid. For the next six years, the Governor held state aid flat, and he is again proposing flat funding in 2017-18. During the Governor’s two terms, state aid increased by a mere 1%, and that takes into account the NJ Supreme Court’s 2011 order to restore $500 million in cuts to the former Abbott districts. In fact, over 40% of districts are actually receiving less state aid than before Governor Christie took office.

Local Revenue

Under Governor Christie, local property tax revenue for schools has increased by over $2.4 billion, or an average of 2.3% annually. Though this increase is significant and far outpaces state aid growth, in many districts the amount of local revenue remains below the district’s local fair share of their SFRA adequacy budget. In 2010, the Governor reduced the cap on annual property tax increases from 4% to 2%. This makes it difficult for many districts taxing below their local fair share to make up the difference. In some districts, it would take decades to reach their local fair share because of cap limitations.

State Aid and Local Revenue Gaps in Below Adequacy Districts

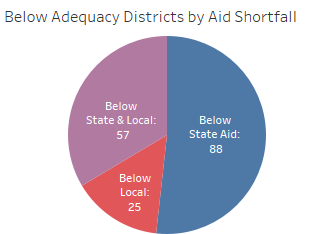

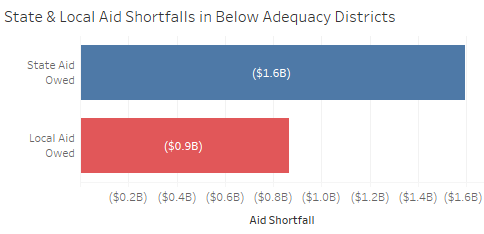

Districts below the SFRA adequacy budget have funding gaps in state aid, local aid, or both. The chart below shows that more than half (88 of the 170 below-adequacy districts) are under adequacy solely because they are owed additional state aid. Another 57 districts are behind on both state and local aid, while only 25 districts are below adequacy because they are not meeting their local fair share.

In total, below-adequacy districts require an additional $1.6 billion in state aid and $0.9 billion in local revenue to fully support their adequacy budgets. In other words, the average below-adequacy district is entitled to about $2,500 per pupil in state aid and over $1,300 per pupil in local aid to support the staff, programs and services necessary to deliver New Jersey’s curriculum standards. Of course, there is great variation, with some districts reaching shortfalls of more than $10,000 per pupil. All districts’ funding levels relative to adequacy are available here.

Moving Forward Post-Christie

The SFRA formula took years to develop with input from local educators, experts and stakeholders. It was enacted with bipartisan legislative support. The principle behind the formula – that school budgets must be based on the level of resources needed to provide a thorough and efficient education to NJ school children – is just as crucial today as it was in 2008, especially as the number of poor children and English language learners continues to grow.

Governor Christie has simply ignored the formula and the needs of children and schools, and he has thrown the SFRA out of whack. Unfortunately, the hole the Governor has dug is now so deep it cannot be filled in one or even several school years.

It will take time to bring districts up to their adequacy budgets. This requires increasing state school aid to formula-required levels and increasing local revenue in districts below their local fair share.

We can start getting the SFRA formula back on track in the FY18 State Budget. Legislators must remove the $1 million earmarked for vouchers in the Governor’s proposed budget, and reallocate the $69 million in charter school “hold harmless” aid to underfunded districts around the state. It will then be left to the next administration to increase school aid each year until full formula funding is achieved.

This news story was updated on May 22, 2017 to correct a calculation error.

Press Contact:

Sharon Krengel

Policy and Outreach Director

skrengel@edlawcenter.org

973-624-1815, x 24

Press Contact:

Sharon Krengel

Director of Policy, Strategic Partnerships and Communications

skrengel@edlawcenter.org

973-624-1815, x240