GOVERNOR CHRISTIE’S UNFAIR SCHOOL FUNDING PLAN: PART V

GOVERNOR TO OVERTAXED TOWNS: RAISE TAXES EVEN HIGHER OR CUT SCHOOLS

Governor Christie claims property taxes will be reduced in New Jersey towns where state aid will increase under his radical plan to redistribute school funding. Yet the Governor conveniently ignores the fact that his plan will also raise property taxes in the 143 school districts targeted for massive cuts in school aid.

Many of the “losers” under the Christie plan are low- and middle-income communities that already have excessively high property tax rates. Given this local tax burden, the school districts serving these communities will be forced to raise taxes even higher or cut teachers, support staff and essential programs to drastically reduce and balance their budgets.

Education Law Center examined the impact of the Governor’s proposal on the 67 municipalities that would experience a school aid cut and currently have total property tax rates above 130% of the state average. This tax rate was used by the NJ Supreme Court in the landmark Abbott v. Burke case to determine “municipal overburden,” which is defined as an “excessive tax levy” to provide a range of essential services to residents, including police and fire protection, road maintenance, water, sewers and garbage collection. Municipal overburden is a common condition in New Jersey’s lower income communities with low property values against which taxes are assessed and high levels of government need.

The 67 municipalities in municipal overburden are served by 66 school districts. The majority of these districts – which would face significant school aid cuts under the Governor’s plan – are smaller, low-wealth districts located in all areas of the state. Eighteen are in the lowest socioeconomic classification used by the NJ Department of Education – District Factor Group (DFG) A – and another 24 are in DFG B, the second lowest. Twenty-one districts are in the lower-middle wealth DFG CD and DE classifications. Only three overburdened districts facing cuts are in high wealth districts.

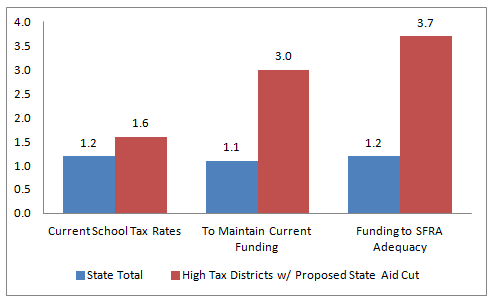

Among the districts targeted by the Governor for aid cuts are Woodlynne, Pleasantville, Black Horse Pike Regional, Egg Harbor City and Lindenwold in the south, and Prospect Park, East Newark, Manchester Regional and Roselle in the north. These districts serve municipalities that have property values far below the state average, in some cases dramatically lower. This means these towns must tax at much higher rates to generate the same revenue as wealthier towns. The majority of these districts already have higher than average school tax rates, averaging 1.6 compared to the statewide rate of 1.2. The school tax rate is calculated as the school tax assessed per $1,000 of taxable property (school levy/equalized valuation * 1000).

ELC estimated how the Governor’s funding plan would impact school tax rates in communities already in municipal overburden. To maintain current education revenues, the average school tax rate in these towns would rise to 3.0, 250% higher than the current statewide rate. If the districts raised local revenues to meet the state’s own determination of adequate funding under the School Funding Reform Act (SFRA), New Jersey’s need-based formula, the school tax rate would average 3.7.

Estimated School Tax Rates Under Governor’s Funding Proposal

The impact on school districts would be devastating. Take, for example, Lindenwold, a low spending school district with over 80% poor students and 16% English language learners. The district is consistently underfunded under the SFRA, even though the school levy is just below what the SFRA determines the community can afford. Lindenwold raises these local taxes despite property valuations per pupil that are one-quarter of the state average – approximately $232,000 per resident student compared to the state total of $896,000.

Lindenwold’s school tax rate is currently about 1.9, above the statewide rate of 1.2. If Lindenwold were to make up the $7 million in proposed state aid cuts with local revenue, the school tax rate would grow to 3.1. If the district were to actually fund schools to the level that the SFRA defines as adequate to meet student need, the rate would balloon to 5.7.

Bridgeton, in Cumberland County, currently spends far below adequacy and is owed nearly $30 million in state aid under the SFRA. The Governor’s plan proposes to cut this district’s state aid by over $40 million. Bridgeton has seen its manufacturing base disappear and is exceptionally property-poor with a valuation per student at less than 10% of the state average. If the district raised taxes to maintain current funding levels, the school tax rate would climb to 10.0; if the district raised taxes to adequacy the rate would grow to 16.1. Of course, there is no way the community could sustain such an enormous tax increase. Instead, the district would be forced to cut essential staff and programs, including services for the large population of students learning English.

These are just two examples among many of districts that will be faced with an untenable dilemma if the Governor is able to implement his plan. These districts would either have to make devastating education cuts that would harm students or drastically increase taxes that would hurt residents, businesses and the local economy.

While this analysis focuses on a subset of districts that are already highly taxed, there are dozens of other districts where school tax rates would surge if the Governor cut state aid, pushing even more New Jersey towns into municipal overburden. For those individuals and families living in these many towns, the Governor’s promise of property tax relief is more than hollow – it’s devastating.

Related Stories:

GOVERNOR CHRISTIE’S UNFAIR SCHOOL FUNDING PLAN: PART IV

GOVERNOR CHRISTIE’S UNFAIR SCHOOL FUNDING PLAN: PART III

GOVERNOR CHRISTIE’S UNFAIR SCHOOL FUNDING PLAN: PART II

GOVERNOR CHRISTIE’S UNFAIR SCHOOL FUNDING PLAN: PART I

Press Contact:

Sharon Krengel

Policy and Outreach Director

skrengel@edlawcenter.org

973-624-1815, x 24

Press Contact:

Sharon Krengel

Director of Policy, Strategic Partnerships and Communications

skrengel@edlawcenter.org

973-624-1815, x240